Alternative Routes for Libyan State to Fund Investment Projects

By Albudery Shariha

Alternative Routes for Libyan State to Fund Investment Projects, as an emerging market, requires development across several sectors to encourage participation from its nascent private sector.

To entice private entities to engage in projects, the State must grant a form of security. International private investors are reluctant to invest in “high risk” countries such as Libya, predominantly due to a lack of financial security for their investments.

Furthermore, investors do not think only about their businesses in the immediate term but also the situation they may be put in if the project comes to a halt in the long term. Consequently, if Libya wishes to encourage investment in it, as a country, it needs to put in place a scheme that protects investors in exchange for entering an unstable market. This protection may come in the form of guarantees.

Libya must undergo development on many fronts at once requires the creation of alternative options to finance such projects through investor involvement in the market. This requires establishing a form of guarantee that is compliant with the current existing laws and bears in mind that the environment investors are operating in is far from certain.

Table of Contents

Objective

The purpose of this paper is to introduce to the Libyan State the alternative routes that it may consider to finance and secure investment projects. We hope this will assist the Libyan State is using its financial resources on short- and medium-term projects, opting to involve private investors in its various long-term projects such as Public-Private Partnerships.

Private financing requires assurance from the government that payments are guaranteed and are not subject to any restrictions that may come in the way of the performance of such payment. This alternative route is the use of the Guarantee Fund as a form of security.

Guarantee Fund Definition

Government Guarantees are a formal method of assurance to investors that affirm that payments are to be immediately in effect and have a strong legal basis. They grant credibility to investors that their funds are guaranteed and under their control once they fulfil their obligations as per the contract. Equally, if any issues arise that makes the investor entitled to financial compensation due to the first party’s liability (public entity), no delay in payment is possible under such a method. This method enhances the private investor’s confidence in undertaking its projects as payments are guaranteed.

According to the World Bank, a Guarantee Fund is defined as “liquid assets that can be rapidly mobilized if a contingent liability is realized. The fund would have its own balance sheet, be removed from the annual budget cycle, and benefit from independent governance.”

The Libyan State must create the Guarantee Fund to manage risks better than they have faced in the past. Such risks involve political issues and/or delay or lack of payment of dues from the government. This history of lack of timely payment by the Libyan State has led to the requirement of initiating alternative routes to encourage the involvement of private investors.

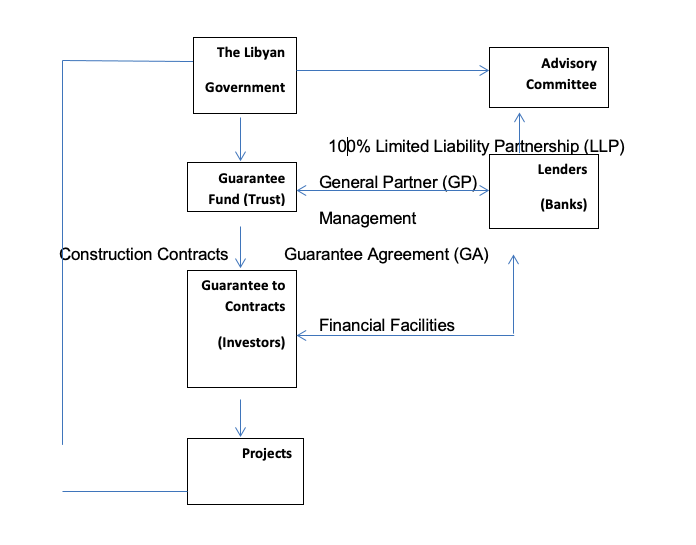

The Fund Guarantee Diagram 1.1

- The Libyan State injects an amount in a trust, to which it is named as a beneficiary.

- The Libyan State remains as a beneficiary for the period specified- that is usually between ten to twenty years.

- The Trust is managed by a number of chosen banks. The banks that are chosen to operate and cover their own costs – they act as custodians or trustees. The banks tend to use leverage to cover their own costs, this is through borrowing funds and buying assets that are expected to return more than the money borrowed and used to buy the assets. This way the bank can cover their costs.

- The fact that the Trust is managed by the banks grants the Libyan State the benefit of the use of the banks resources to assist it in various aspects including carrying out due diligence exercises, compliance, allows for project quality, reduces costs as investors undergo a review by the bank, and increases transparency.

- The banks will closely monitor investors as they will be concerned about their reputation. Furthermore, there will be no political risks involved as the fund is managed outside of Libya. Note that Libya, in the Country Risk Report, has a score of 7/7 which is very high risk.

It is suggested that independent trustees are used as an alternative to bank trusts as an alternative to the option above. Various independent trustees manage the fund to ensure performance outside the banking problems/issues. This particular aspect will require further research into the tax regime applicable to find the option that is most suitable financially in terms of tax implications.

Experience Across Countries

Several countries have put into effect the usage of Fund Guarantees. These include Indonesia, Sweden and Greece. The most relevant experience in Indonesia, as it has similar issues to Libya in land and construction.

Current Issues in Libya

To develop the various sectors that need development in Libya, several issues need to be addressed. There are two types of risks involved in the current Libyan market.

- Commercial/Credit Risks; and

- Political Risks

The first type has been resolved through a bank guarantee; the latter may be resolved through either a Sovereign Guarantee or a Guarantee Fund. Under the current Libyan Laws, the option which refers to the Sovereign Guarantee is not an option. As the Libya Public Credit Law, No 15 of 1986 (in its first provision) does not allow the Libyan State to grant any forms of Guarantees that involve State assets.

It may be viewed that a change in the law is necessary to allow for such a guarantee, similar to the case of other countries that allow for this option – but this is not enough considering the history of the Libyan state and payment delays.

The lack of confidence and trust amongst private investors towards the Libyan Government or State makes the sovereign wealth fund the least favoured option. There are various Risks involved; such risks include but are not limited to the following:

- License /Permit Approvals.

- Changes in law which affect costs.

- Competition i.e., where similar facilities are built which eventually compete with the delivery of the agreed services.

- Investors actions influencing the demands for the project’s services.

- Pricing risk that occurs due to unilateral changes in tariff.

- Risk of expropriation.

- Risk on revenue/profit from the project which could not be converted to the foreign currency or transferred to the investor’s home country.

- Risk of Force Majeure.

- Risk of the method of delivery.

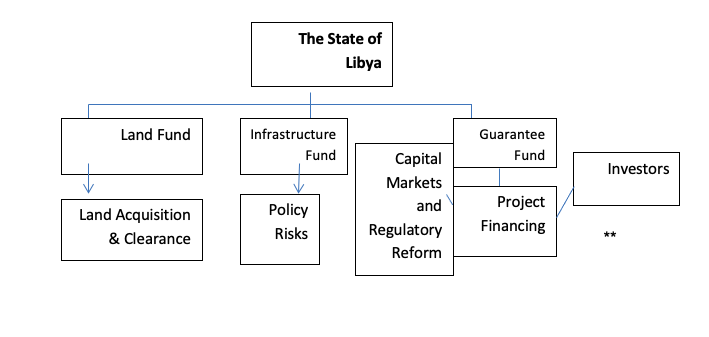

The Libyan State must look into alternative options, following the Indonesian example – being a country dealing with similar issues; Libya is encouraged to create the following supporting means:

- Land Fund;

- Infrastructure Fund; and

- Guarantee Fund

Diagram 1.2 the required Supporting Institutions to encourage Investors

**Source of this Diagram: IIGF Indonesia Infrastructure Guarantee Fund, The Role of IIGF in supporting bankable PPP Projects in Indonesia

Land Fund

An amount of cash is allocated for land issues that require immediate attention before the project’s initiation, during or after the completion of the project. Given the problems in Libya regarding land, it is necessary to create this fund to bring back confidence within the investor community to start projects in Libya.

Note that in Libya, since the 1970s, the issues of housing include the one-family principle, which means that each Libyan family is entitled to one house. The rest are granted to occupying it (through lease). Ownership and land titles have been in a chaotic state.

Land in Libya carries a risk of being revoked by the actual owner, and as such, various lands are subject to dispute. Having no proper records of such titles due to the destruction of such documents during the previous regime makes such issues even more complicated. To avoid pulling back from investors interested, there is a need to protect the land, which may be subject to a dispute later on.

The Land Fund will act as security to the investor; to provide clarity on land issues that the investor may face during any of the stages of its project. This will put necessary confidence in the private investors to start projects without being concerned about the land after having done the required due diligence, as they are covered in case a dispute arises.

Infrastructure Fund

This is similar to the land fund, except it is tailored to the needs of infrastructure projects. It is a pool of cash allocated to resolve issues that may arise prior, during, or after the project is completed. The need for various infrastructure projects in Libya, such as water, power, transportation, and waste, among other needs within the Libyan State. The funding of all these projects at once will constrain the government’s balance sheet and prevent it from doing its other important tasks. The allocation of funds as a form of security to the investors will allow the private investors to undertake such projects at their own costs, knowing that if an issue arises, they are financially covered.

Guarantee Fund

This is a form of security that is activated in case any form of liability arises. This type is held in the form of Trust. The bank holds the Trust for the benefit of the Libyan State. The investor can use it if any form of financial liability arises once the investor is offered guarantees that if any liability arises that appropriate funds are allocated to resolve it, they are more likely to accept entering a market considered high risk.

Under the current Libyan Laws, the concept of Trust is not dealt with at all. There are various contradictions in applying the trusts about individuals but not about the Libyan state. The concept of trusts is not widely understood in Libya; its implementation is not considered. The concept needs to be introduced and its relevance brought under the spotlight. In Libya, fund guarantees may be used as a form of security to support government PPP initiatives. Without such guarantees, the possibility of PP projects becomes slim.

Various fund guarantees may be used in Libya, including Finance Guarantees and Contractual Guarantees. The first type is geared toward the lenders, whereas the second type is geared toward the investors to encourage them to undertake the project.

Conclusion/ Recommendation

- Master plan.

- Intention of Government.

- PPP Guideline/platform/legal framework.

- A need for a Guarantee Fund/Land Fund.

- Pilot project.

- Legally Guaranteed Fund could be much better than re-arranging the law.