On Tuesday, July 7, Libyan Prime Minister Abdul Hamid Dbeibeh signed Decree 642/2022, which removed from office with immediate effect the entire board of directors of the National Oil Corporation (“NOC”) – including long-time NOC Chairman Mustafa Sanalla. Former Libyan Central Bank Chairman Farhat Bengdara was appointed as Mr. Sanalla’s replacement.

Mr. Sanalla is resisting his removal as illegitimate and is challenging this decision before the Court of Appeal in Tripoli (administrative division). During a hearing held today (17th August 2022) the case has been adjourned until 7th Sep 2022.

As Libyan Oil Minister Mohamed Emhamed Aoun has been strongly supportive of Mr. Bengdara’s appointment, Mr. Sanalla’s legal challenge appears unlikely to succeed in the short to medium term. Moreover, most of NOC’s subsidiaries and affiliates have already publicly acknowledged Mr. Bengdara’s appointment.

Although, at first glance, this episode appears to be yet another example of worrisome institutional instability in Libya, upon reflection, this development may actually cause a positive ripple effect. For example, the ongoing blockade of Libya’s eastern oil ports of Brega and Zueitina was lifted within 24 hours of Mr. Bengdara’s appointment and, in a recent interview on Libyan television, Mr. Bengdara himself went as far as to raise the prospect that the NOC may for the first time seek to itself raise hard currency funds for future investment from outside the Libyan state budget, in the form of bonds or loans from financial institutions, foreign energy companies and/or the Libyan private sector.

Although allowing the NOC to raise finance in this way will require various changes to existing Libyan laws, early indications are that the required legal flexibility may now become achievable, as Libyan political leaders consider how best to capitalise on the current geopolitical moment, with European countries scrambling to source alternative supplies of oil and gas in order to reduce their dependence on Russia and oil prices moving above $120 per barrel. Libya’s massive and under-exploited hydrocarbon reserves give it significant leverage in this environment.

We will continue to monitor developments and provide updates as they occur.

A Review of the Oil & Gas Industry in Libya

Although Libya is a member of the Organization of Petroleum Exporting Countries, it is not bound by a production ceiling because of its ongoing political crisis. Consequently, Libya is currently free to extract and export as much oil and gas as it wants.

Moreover, the geographical location of Libya makes exporting oil by sea easier than for other producers. The Oil Ministry recently announced that Libya was targeting production of 1.2 million barrels daily in 2022, which represents a significant change considering that oil production stopped for three months, between April and July 2022. As the geopolitical impact of the Ukraine war accelerates the search for producers other than Russia, these additional barrels from Libya may play an important role in the oil and gas market going forward.

Libyan Petroleum Law

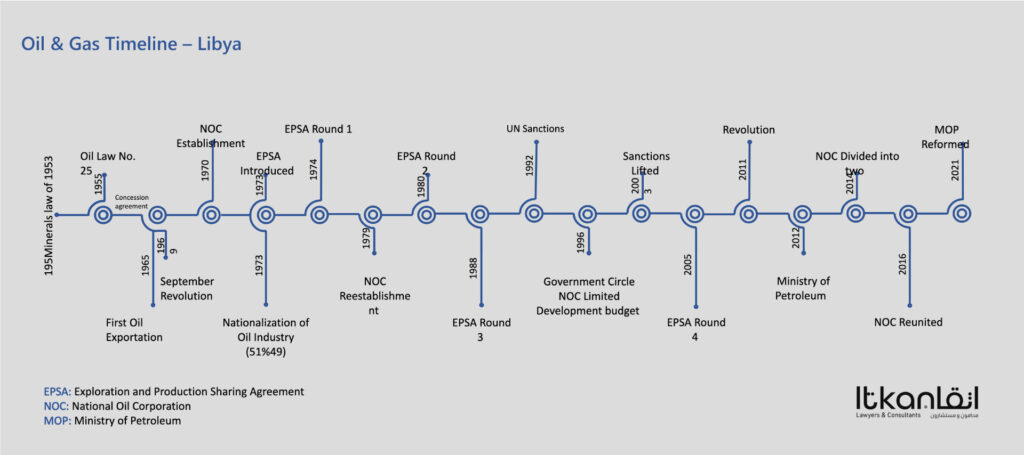

The oil industry in Libya is governed by Law No. 25 of 1955 (the “Petroleum Law”). The Petroleum Law divided the Libyan territory into four petroleum zones and established an independent Petroleum Committee with several responsibilities, one of which is determining the eligibility of applications for licences and concessions. According to the Petroleum Law, companies are eligible to participate in the Libyan oil sector provided that they comply with all laws, have been previously active in the petroleum industry, and have adequate experience and financial and technical capacity to conduct the work. The Petroleum Committee is empowered to grant concessions pursuant to the terms set out in the Petroleum Law. These terms may be amended as required, provided that such amendments do not give prerogative rights to one company over the other.

The Petroleum Law also determines the obligations of concession holders in respect of the nature and timing of the work to be done, as well as defining the fees, royalties, taxes and profit distribution obligations applicable to oil and gas activities.

Libya has traditionally used standard form Exploration and Production Sharing Agreements (“EPSAs”) to govern its oil and gas sector. All EPSAs are entered into between the National Oil Corporation (NOC) – representing the Libyan State – and international companies. Each EPSA determines the percentage of oil and gas projects that may be held by international companies and sets out various rules applicable to exploration and production activities. Both parties share the expenses of exploration and production and pay taxes and royalties in agreed percentages. The economic conditions applicable to specific exploration and production projects are determined according to the level of difficulty of such projects, as adjusted for fluctuations in prevailing international prices.

In 1974 Libya adopted its first standard-form EPSA (“EPSA1”). At the end of the seventies, a revised form EPSA2 was adopted, followed by EPSA3 in 1988 and EPSA4 in 2004. In general, EPSA4 increased NOC’s equity ownership in Libyan projects in exchange for tax and royalty exemptions granted to international companies. This approach created several advantages for international companies. First, unlike all previous EPSAs, under EPSA4, international companies are exempted from all taxes and royalties, even those payable against their equity shares (with the NOC being responsible for payment of all taxes and royalties. Second, EPSA4 opened the door for international companies other than western ones to invest in oil & gas projects in Libya. Third, the EPSA4 rules eased the procedure through which tenders are managed, thus making it easier to execute projects and decreasing corruption risks by preventing state-owned companies from intervening in tendering activities.

A New Form of EPSA?

In light of the current circumstances in Libya, some industry observes believe that a new “EPSA5” may be on the way. This is because the State Development Budget for the Oil & Gas Sector will not be sufficient to cover the NOC’s investment needs, meaning that the government may decide to increase incentives for inbound investment, particularly with respect to some relatively smaller fields that find it difficult to attract the attention of big companies. One possible approach may be to reconsider the exclusion of the Oil & Gas sector from the activities permitted to be invested in by international companies under Investment Law No. 9. Alternatively, the legislature may decide to reconsider the draft Petroleum Law that was initially prepared in 2008.